So a couple of readers pointed out that something was wrong with the math that suggested I just might manage an apartment in San Francisco for myself, if and when M’hijito makes his escape from Phoenix. Dead right: the problem was that the figure I was using for the 4% and 5% drawdowns, which I had lifted from another column, actually represented the drawdowns plus Social Security. Having blithely forgotten that small detail, I added Social Security in on top of those, for a net income whose optimism exceeded rosey.

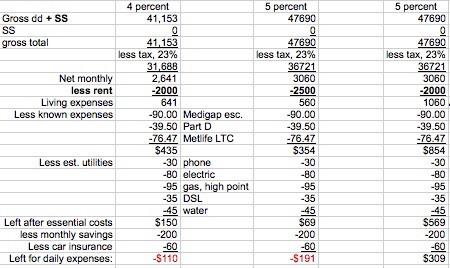

Remove the extra Social Security contribution and you get figures that look like these:

Even if I could find a comfortable place for $2,000 a month—a highly unlikely proposition—nothing even vaguely like enough to live on would remain after the inescapable costs. Realistically, I’m finding that I can’t get by with much less than $700 for monthly discretionary expenses, because there’s always some repair bill or unexpected cost to be paid. Even if I put nothing into the monthly diddle-it-away fund (from which I buy clothing, an item that I really can’t do without…especially in San Francisco ;-)), there’s simply not enough left after rent, health insurance, long-term care insurance, and utilities.

And the fact is that even in the make-believe scenario, my figures didn’t take into account the higher tax rates, nor did they anticipate the inevitability that rents will increase when the economy improves and demand for housing increases. Right now, rents are low in the City, but as soon as commerce heats up and more people migrate to San Francisco, landlords raise their rent rates accordingly.

As for moving to some other venue in California: really, there’s no place else in that state that I want to live. San Francisco has a special allure—it’s a one-of-a-kind city. But the whole state is overrun with people, most of them living in Southern California-style ticky-tacky. I already live in Southern California East; why would I want to spend more to live in the same conditions there?

I guess if M’hijito moves back to San Francisco, I’ll just decamp to Prescott, which at least is a little cooler than the Valley. It used to be a little more urbane, too, in a funny way, a little more resident-friendly—but that’s less so today.

So sad. Living in SF would be amazing! I lived there once many years ago in a studio apartment in the Marina District (high rent then-don’t know about now). That is really the only time I’ve lived in a big city and I didn’t totally love it then, but sure have some great memories and wish I’d appreciated it more while I was there.

Could you be roommates with your son? Splitting the cost of a house or larger apartment could possibly make it affordable. I know I wouldn’t want to live with my grown kids as roommates, but everyone is different.

I’m sure there is a way. You just have to be creative. I’m going to write about this…

What about part time teaching? They probably pay more if cost of living is higher

It looks like it could be a little higher. Here’s a comment from a bulletin board:

. . . .

“… I hope no one lets the air out of my tires for this, but I teach at the largest Community College in San Francisco, and adjuncts who teach English Composition (considered an “overload”) get $84 an hour to start–which at 3 contact hours a week, and 16 hours a semester, adds up to $4032 a semester. Since I’ve been there for 5 years, I make $106 an hour–which adds up to $5088 a semester. I am allowed to teach two courses (only two) in this department.”

. . . .

Well, at PVCC I can teach three sections at $2,400, which adds up to $7,200, significantly better pay.

And holy mackerel, check out what this one claims to be doing:

. . . .

“I am working for 2 schools right now, and start a third this fall. Most school’s sessions are only 5-6 weeks long, and pay as much as your 10-15 week semesters. I think its great that everyone tells how many credit hours their classes are, but what does this translate into time? I used to teach for one online school anyware [sic] from 3-4 classes every 5 weeks at $2000 a pop. That averaged about $6000-8000 a month. Not bad. That program was streamlined down from 20 courses to 10 (of course, after I moved into an expensive apartment) so now I only teach 1 course for them (not enough classes to go around). It’s still $2000 every 5 weeks, no benefits. The other school pays $1500 a course every 5.5 weeks, and I get about 2 a session. So, $3000 plus $2000 is $5000 every 5 weeks. I am starting with another online school, but these courses are 10 week courses, and are $1500 a class. I think this is a huge rip-off. Do the math, I can make more at McDonald’s. I have no idea why these schools think they can get intelligent, experienced people for so cheap. This last school is in Colorado, and by previous posts it seems that this state is a bit “bfe” or boonies, and they don’t realize that “city folk” need a bit more money.

“My goal is to get to around $3000-4500 every 10 weeks with the Colorado school (2-3 courses a session), and average around $7000 a month. I live in “America’s Riviera”, and a 1 bedroom is $1100 a month. This is not luxury, but central air and few palmetto bugs (the beach is close). If you want to make more money, make the transition to online education. I have been doing this for 3 years, and have experience. The schools basically beg you to work for them. If i was smart, I should move to Mexico, on the beach, were [sic! what part of the “wh” sound don’t you understand?] a high-speed connection is all I need. The cost of living would be awesome. I am starting to learn about day trading, also. This, coupled with online teaching, and I can live and work anyware [sic!!!]. I am also single.”

. . . .

Gosh. Can you imagine what a shitty job of teaching those bogus online courses this person must be doing? Probably teaching the little darlings to spell “anyware.”

Source for these bons mots: http://www.adjunctnation.com/forums/read.php?83,982,page=3

A few more thoughts off the top of my head:

re: “I can’t get by with much less than $700 for monthly discretionary expenses, because there’s always some repair bill or unexpected cost to be paid.” If you’re renting, the landlord picks up repair costs (a/c-heat, maintenance etc) AND often at least some utilities are covered by your rent. Not that I’m saying that would make it affordable for you, but might help your figures!

Also, I’ve been in CA too long now to know how car registration & insurance costs compare to other states, but it’s really expensive here these days…. & don’t forget that gasoline prices run higher than the national average.

I’m assuming the $200 for savings you show is toward your emergency expenses and/or your ‘diddle away fund’? Otherwise why would you be putting money into savings while collecting retirement?

But rent won’t increase much in SF as long as you are in place that is a bit older (you would have to check the cut off year) because it will be rent controlled.

The budget, that Excel document that you religiously plan to stick to…

Don’t make it to tight as Murphy is still at large.

You know Murphy’s law.

Make sure you have room for Mr. Murphy.

If you make it too tight, so tight that it squeaks you are doomed.

Tight is a gnats a$$ stretched over a 55 gallon oil drum.