God, for an English major I am too, too bizarrely fascinated with playing in Excel sandboxes! Just came up with a new budget scheme: instead of tracking expenditures by the month, why not track them over the course of a year? Since Fidelity will be sending savings drawdowns annually, and since one annual drawdown will, in theory, cover all my living expenses, who cares how much is left at the end of a month? When you’re living on retirement savings, the figure that matters is what’s left at the end of the year.

Annually, my living expenses — exclusive of taxes, insurance, and minor emergencies (which are covered by Social Security and teaching income) — come to $1721/month. That’s based on the maximum costs of air conditioning and water, which occur during the summer months; during the winter, total costs are somewhat less, because I rarely turn the heat on and I don’t have to water the yard or refill the pool much. That works out to $20,652 a year, just to get by.

So here’s a research question: If you tracked your budget by the year, would over-expenditures (such as I’m enjoying right now and expect to continue enjoying through March!) eventually balance out with under-expenditures? Well, in 2014, we’ll find out.

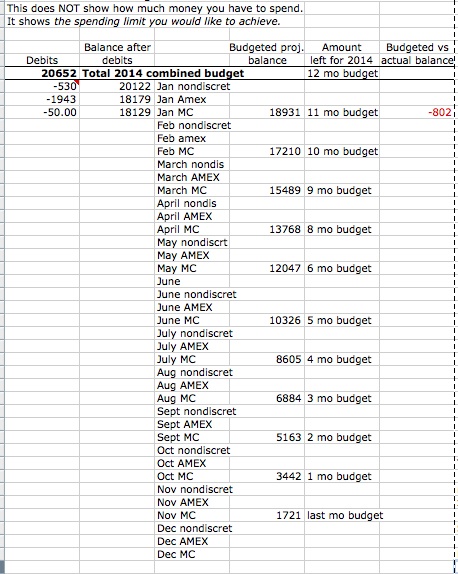

We have the research instrument:

By subtracting $1721 for each month, I can easily see how much is left for the remainder of the year at any given time. This does not reveal the amount that’s actually in hand — or will be — for 2014. The teaching income will cover most of the tax and insurance charges, and Social Security will cover what obviously is likely to be a serious shortfall in the budgeting scheme, plus any major unexpected expenses.

By subtracting $1721 for each month, I can easily see how much is left for the remainder of the year at any given time. This does not reveal the amount that’s actually in hand — or will be — for 2014. The teaching income will cover most of the tax and insurance charges, and Social Security will cover what obviously is likely to be a serious shortfall in the budgeting scheme, plus any major unexpected expenses.

If I subtract a) the balance after a given month’s debits (shown in the column titled “Balance after debits”) from b) the balance that the budget should show at the end of that month, were I managing to stay on budget (shown in the column titled “Budgeted proj. balance”), then I will see c) far how into the red or the black I happen to be at that time (shown in the column titled “Budgeted vs. actual balance”).

Budgeted projected balance – Balance after debits = Budgeted balance compared to current balance

Lovely. I’m already $802 in the hole. This includes the down payment on the four pairs of glasses, an accountant’s bill, a car repair bill, and $680 for the massive tree-pruning job. Plus the $135 to My Sister’s Closet for a little bonanza in second-hand clothing, purchased before I realized I was riding a waterslide into a pool of red ink.

That does not include another $430 owing toward the glasses, God only knows how much for contact lenses, God only knows how much for the visit to the ER, and the $800 still owing for the puppy, an amount I had stashed conveniently away before I got walloped with a new set of medical and vision bills. And of course we’re still faced with the fact that about the only rags in the closet that fit me are a few Costco bluejeans. And a couple of uncomfortable bras.

Welp. It certainly is a good thing Social Security is still operating.

🙄

Great idea! I track my budget in an annual spreadsheet. I track everything I spend each month on one worksheet. I then add up each category and transfer the money I spent in each category onto the annual worksheet which has a column for each month. Its too bad I don’t know how to put a spreadsheet in a comment, but it essentially looks like this:

Column 1 Columns 2-13 Column 14 Column 15

$Amt avlbl Month 1 to Month 12 Total spent Amt left for year

I predict what I will spend in each category every month. I base it on what I spent the year prior. I can adjust up or down as the year goes on and I can add money to one row, but then I have to remove it from a different row to make the total add up to my salary. I include savings in the spreadsheet. It works well for me.

Yesh. I do something along those lines. Inflation has been fairly low, so all I’ve had to do is adjust insurance and property tax upward (actually, Part D and car insurance went down). But as the economy recovers, basing it on last year’s figures and maybe adding 3 percent would be smart. Very smart.

I’m afraid if I tracked my budget annually, too many things would slip through the cracks, as I’m not the most detail oriented person. But I already predict my annual expenses, too, so it might not be that hard of a change. Definitely an interesting thought!

Well, it’s an idea. When I was earning a salary, it would’ve been out of the question — at least psychologically. But now that the basis of my income can be made to come in once a year, it sort of makes sense.

The big problem I have with it is this: When I look at the online bank account and see a whole year’s worth of $$$ in there, what I see is a bottomless pit. That makes it too, too easy to spend with abandon. If I imagine I only have $1700 +/- at any given moment, I’m going to be a lot less likely to blithely splurge on whatever catches my fancy.

Since you see a “bottomless pit” of money when you have a year’s worth in the account, why don’t you test your idea out in a less extreme way? Perhaps take out money quarterly…

Tried that. It’s a real hassle. In the new bookkeeping regime, I’m trying to minimize the number of transactions to keep track of. Entering all that stuff in Quickbooks and Excel is horribly time-consuming, and now that I’m hiring an accountant to do the heavy lifting, it adds to her (by-the-hour!) workload.

I think that knowing there’s $1720 available in any given month will be enough of a cudgel. This month we’ve seen a blizzard of outrageous expenses, notably the vision system, the car, and the puppy.

Too bad I can’t tolerate contact lenses 12 or 15 hours a day — a whole box of the things only costs $60!

Interestingly, in the new diet regime I’m spending so much less on groceries (the Food Impulse Buy is a thing of the past) that even with the occasional extraordinary expense I usually do OK and sometimes come out a little ahead. Considering the phenomenal amount I spent on the unwelcome extra expenses, that I came out only $800 in the hole is something of a miracle. I actually anticipated an AMEX bill of $3000 or more, and lo! it was only $1950.