A miracle has happened: January and February expenditures came in well under budget. On average, I figure to spend $657 a month for nondiscretionary bills (factoring in the high summer utility bills with correspondingly tiny winter ones) and about $1200 for things I have some control over. Total budgeted for day-to-day expenses: $1857/month.

In January, I managed to come in at $1,665, and in February, at an amazing $1,447: TOTAL. Hot damn!

February’s discretionary spending was kept to an almost incomprehensibly low $862, in spite of the $240 brake job! Nondiscretionary expenses, which now include a couple of maintenance expenses I used to regard as discretionary but have moved into the inescapable category, amounted to $615.

Not bad.

In February 2014, the Year from Hell, I spent $2,188. Every month during the YfH brought another unplanned expense, some of them large. Overall in 2014, I spent $2,727 on the dog, $2,233 on little surprises like pool repair and maintenance, plumbing ripoffs, the air-conditioning ripoff, replaced a pair of very expensive glasses I lost, and on and on and on. Clearly the $765 I donated to charity was about $765 more than I could afford. These costs, of course, did not account for the couple thousand for Medigap, the amount for Medicare Part D, the property tax, the homeowner’s insurance, or the auto insurance. By the end of the year, I just barely broke even — only because I’d taken $11,000 out of savings to live on, an amount that far exceeded projected needs.

The YfH consumed all of that 11 grand, plus the money I earned teaching seven sections, plus all of my Social Security.

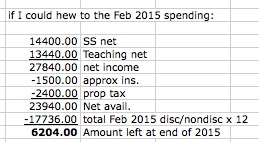

How amazing would it be if I could keep costs down to the February 2015 level? Well, here’s how amazing:

Yes. If I lived in Never-Never-Land, where every month is February and the temperatures never rise above 80 degrees or drop below 60, I could in theory end the year $6200 in the black, without drawing down a dime from savings!

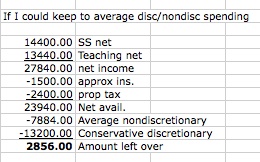

We know, however, that we live not in Never-Never-Land but on the Other Side of the Looking Glass, home to the Cheshire Cat and the Queen of Hearts. In that ever-so-much-more realistic world, I’ll be lucky to stay on a budget based on average 2014 non-discretionary, non-emergncy costs:

In this scenario, I’d have about $2,860 of budgetary play, enough to cover a few unplanned emergency expenses if none of them is very large. Even that is not bad, because — amazingly — it still suggests that if I can keep a death-grip on expenses, I might not have to draw much down out of retirement savings to survive the year 2015.

In this scenario, I’d have about $2,860 of budgetary play, enough to cover a few unplanned emergency expenses if none of them is very large. Even that is not bad, because — amazingly — it still suggests that if I can keep a death-grip on expenses, I might not have to draw much down out of retirement savings to survive the year 2015.

That, as we know, is not going to happen: we still have no idea how much I’m going to end up owing the Mayo, after all is said and done by Medicare and Medigap. I’m sure it’ll be at least $2,000 and wouldn’t be surprised to see the total come in at around $5,000. I’ll be unhappy but not very surprised to get hit with a $10,000 bill.

So, it will behoove me to continue to keep an iron grip on costs.

What does that actually mean?

Keeping to the February budget (assuming that were not made impossible by the summer power and water bills) will mean essentially living under house arrest.

In January, I hardly went out of the house at all. For good reason: convalescing from the January 6 surgery consumed most of the month.

In February, I didn’t feel much like running around town, but I also suffered a spate of Bag Lady Syndrome. I determined to get a grip on the spending. And that meant not going out of the house at all unless absolutely forced to. I’ve barely left the house except to walk around the neighborhood, run down to the church, and go to a doctor’s appointment. As the budget cycle ends, I’m out of groceries, out of dog food, out of gas, and out of just about anything else you can name.

To stay on this tack, maintaining expenses at the lowest possible figure for any given month in any given season, I’ll have to pull off the following tricks:

• Never go to any event of any kind that costs money

• Never eat in a restaurant

• Restrict Costco trips to one a month

• Restrict grocery trips to one a week

• Purchase no new clothing, not even anything to accommodate the new Boobless Wonder look

• Purchase no new shoes

• Travel exactly nowhere

• Avoid driving the car as much as possible

• Do not donate one red dime, no matter how worthy the cause

• Do not repair or replace things if they can be left to limp along or done without

• Do not get my hair done

• Stay away from veterinarians

• Stay away from doctors

• Stay away from dentists

After just two months of house arrest, I can assure you that I’m already going stir-crazy. Getting used to living like this is going to be a challenge, although I will say I did it after I was laid off the job. But I am not pleased at the prospect of making it a permanent Thing!

SDXB, who lived like this out of choice so he could quit his job in his late 40s, used to have a long list of Free Things to Do. It’s surprising how many there are, from hiking in the local mountain parks to Bum’s Night at the city museum (yeah: the local museum lets people in for free on Wednesday evenings). There’s a free lunch-time music event in Scottsdale, and low-cost or free lunch-hour plays downtown (or there used to be — those may no longer be operative). Biltmore Fashion Square, an upscale shopping mall, is dog-friendly — you can take your dog over there and loaf around their central greens, and even take the pooch into most stores that don’t serve food. One could take up art again and go paint or draw en plein air.

Art supplies, though, cost money.

Or, of course, one could go grade student papers…

Do you have a laptop where you could take it and work at another location like a public library? Just setting up shop there puts you in a different place, a different atmosphere, around other people, and hey, if you get bored or need a break, you know you can grab a book and read for a few minutes.

SDXB seems to have it figured out I think…Maybe take a page out of his book. If it’s free …it’s for me!!!