Okay, so now that I’m a rich old retiree, instead of doling out a few bucks per month or per quarter from retirement savings to meet day-to-day living expenses, in 2014 I decided to draw down enough to cover the entire year’s living expenses, taxes, and insurance, dump it into checking, and hope it lasts 12 months.

Because a) I’m not very competent with math and b) I tend to overcomplicate things in my desperation not to make a mistake or overlook things, my budgeting spreadsheets have become hideously involved. “Tangled,” actually, is the word we might use. When I look back over them and try to remember why I made this or that decision, I can’t figure out what on earth I was thinking.

So, I decided to start all over.

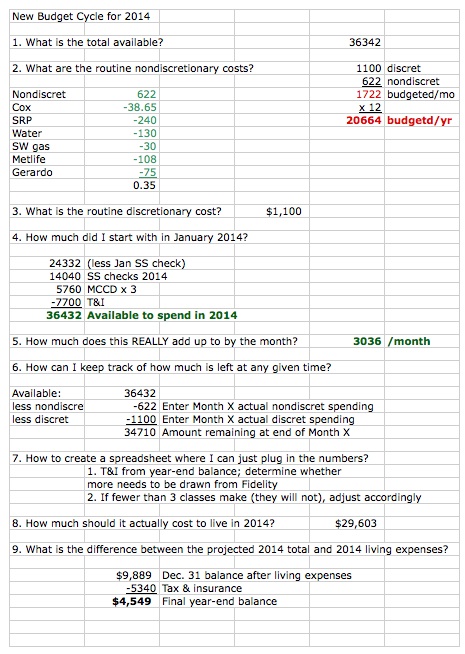

Step 1 was to pose a series of questions designed to lay out the data needed to create a coherent, uncomplicated, nonstupid, and reasonably accurate budget. Videlicet:

1. What is the total amount that will become available from all sources (savings drawdown, Social Security, teaching) during 2014?

2. What are the routine monthly nondiscretionary costs?

3. What are the routine monthly discretionary costs?

4. How much was in the bank on January 1, 2014?

5. How much do the two spending categories really add up to by the month? (i.e., not how much do I think they add up to…)

6. How can I know how much is left at any given time?

7. Can I create a spreadsheet where I can just plug in monthly discretionary, nondiscretionary, and extraordinary totals (“extraordinary” = unexpected costs) and get a snapshot of where I stand at any given time?

8. How much, realistically, should it cost to live in 2014 (i.e., including extraordinary costs, taxes, and insurance)?

9. What is the difference between projected total 2014 funds available and the projected realistic 2014 cost of living?

Step 2: Fill in the answers:

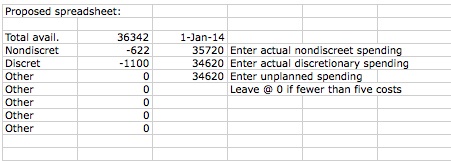

Step 3: Figure out a relatively simple way to keep track of expenditures so I’ll know whether a) this is right and b) I’m about to run into the red.

Step 3: Figure out a relatively simple way to keep track of expenditures so I’ll know whether a) this is right and b) I’m about to run into the red.

In this scheme, the first line of the spreadsheet shows the total amount I believe will come available over 2014. This includes 12 Social security checks and future teaching earnings for three sections. Because there’s a good chance I may teach four sections this year, the $36,342 shown on January may actually be conservative.

In this scheme, the first line of the spreadsheet shows the total amount I believe will come available over 2014. This includes 12 Social security checks and future teaching earnings for three sections. Because there’s a good chance I may teach four sections this year, the $36,342 shown on January may actually be conservative.

Now the idea here is to add up, once a month, all the nondiscretionary expenditures (utilities, long-term health care, yard dude) and enter that total each month; add up all the nondiscretionary costs (these would be the AMEX and Mastercard bills, since I charge almost all nondiscretionary expenses); enter (among “Other”) any extra incoming funds, such as the checks from Medicare and the Medigap insurer; and enter any extraordinary expenses, also among “Other.” Then keep a running balance in column 3.

Thus at the end of any given month, the balance should show how much money remains to cover 2014 living expenses.

The glasses, the ER visit, the eye specialist’s ministrations (much of which were disallowed by Medicare & Medigap), the contact lenses, a car repair bill, the landscape improvement needed to redirect rainwater away from the back patio and wall, extra pay for Gerardo to fix the landscapers’ screwups, a dental bill, and clothing to replace items that no longer fit after the 30-pound weight loss have already racked up a phenomenal amount of “extraordinary” bills — as much as I had planned on for the entire year. And they don’t include the $800 I’ll have to pay for the puppy a couple of weeks hence, plus the veterinarian’s puppy exam, plus the food and gear for the pup, plus the obedience training class, plus the remaining shots, plus the spay job. Pup may not need to be spayed until 2015. But she probably will come into heat by the end of this year. If so, she’ll have to be “fixed” forthwith.

All that nothwithstanding, though, when the January and February bills are plugged into the new spreadsheet, things look a great deal brighter than I expected:

So the balance at the end of this month will be $31,164: more than the projected cost of living for all of 2014.

So the balance at the end of this month will be $31,164: more than the projected cost of living for all of 2014.

That’s not as cheering as it looks: to get the true picture, we have to subtract the cost of taxes, homeowner’s insurance, car insurance, Medigap insurance, and Part D insurance. That leaves us $25,824 to last from March 1 to December 31. That’s still slightly higher than the $20,664 budgeted for 2014 ordinary living costs.

Assuming unbudgeted “extraordinary” expenses will average out, over the year, to around $300 a month, the total cost of living should come to $23,664 in 2014. Even with taxes and insurance added, that will put me in the black this year. Anything left at the end of December will defray the amount of 2015’s saving’s drawdown. And every dollar that stays in savings now is a dollar that will help support me in my dotage.

That certainly is a huge improvement over the grim outlook I enjoyed in 2010, 2011, and 2012, when every goddamn month posed the question of how to make ends meet while living like an anchorite. In 2013, things were a little brighter — at least it didn’t look like my house was likely to be condemned for taxes. It may also just be that the convoluted system I’ve been using obscured the difference between the amount I would need this year and the amount I pulled out of savings. Either way, this year things look pretty good.

Probably it’s because the economy is better — investments have recovered so much that total savings are now almost back to where they were before the Crash of the Bush Economy, meaning that the overgenerous drawdown I seem to have made this year plus the amount that covers my share of the downtown house’s mortgage together do not exceed 4% of total savings. If I’m right that drawdowns can be much more conservative, it looks like things budgetary can continue as they are for the foreseeable future.

Bueno!

Funny, I work for a vet. In regards to the spay, our vets recommend the spay/neuter be done at about the 6 mth mark, after they have lost their baby teeth.

That would make sense. A lot of female dogs come into heat at about 6 or 8 months.

Supposedly spaying before the first heat protects the dog from mammary tumors. I haven’t done the research to track down legitimate studies that show this, but have heard it from veterinarians.

Usually more expensive to spay when a dog is actually in heat.

Yesh. However, dogs do not stay in heat forever, as women do not bleed forever. As soon as the first heat passes, it will be off to the veterinary surgery. Assuming, of course, that said trip was not made in time to head off the first heat.

Oh, Funny – I’m awed. Your “simplified” budget makes my eyes cross!!

But I still love your blog and read it whenever I turn on the computer.

That’s because numbers make MY eyes cross!!! 😆

Do you count your editing income in there somewhere? (I am reading in a rush, so I may have missed it)

No. The editing income goes into an S-corporation. It can pay me a “salary” if it earns enough to do so. So far, it earns enough to pay the DSL connection, website maintenance fees, and cover the cost of computer connections, supplies, and office furniture but hasn’t exactly made me rich. To the extent that it gives me a drawdown, so far this has been carried as loan repayment against the original capitalization.

I say whatever spreadsheet works for you, use it! My spreadsheet is extremely detailed. To the untrained eye, it could cause a stroke – hallucinations, at least. I think I have 30+ categories of spending. But I’ve been using it for over 10 years and it works for me.

I like the way you do it – pull out what you will need at the beginning of the year and budget from there. I look at my budget from an annual basis as well.

Just out of curiosity, what would you do if the income you expect doesn’t materialize (ie classes get cancelled, etc). Or if you end up with an unforeseen bill? Would you pull more money from your investments or would you find a way to decrease the rest of your spending?

My accountant has been lobbying for simplification, and I’ve been at least TRYING to follow her advice, on the theory that a CPA must know a lot more than I do.

On the question of what to do in a LARGE unexpected event… Well, fortunately, there’s a nice amount of money in savings, and, in case of major catastrophe, the house is paid off.

If a class gets cancelled, I think I’ll be OK. That is extremely minor — you can’t imagine how little adjunct teaching is paid. There’s enough wriggle room to make that a low-level emergency (let’s call it an “LLE”), and in the past I’ve learned enough frugal strategies that probably I could adapt to an LLE.

A truly HUGE unforeseen bill — let’s say a year or two, or the rest of my life, of nursing home residence — would be a problem.

In the case of the latter, I do have long-term care insurance; I believe that current incoming (Social Security, normal annual drawdown) plus LTC payouts would cover most of that. If not, a reverse mortgage would probably do the trick.

In the case of a truly extreme scenario — LTC refuses to cover care, costs go through the roof, life is no longer worth living — I have two pistols and I am not above using one or the ‘tother of them. Suicide is painless, so they say…

Yikes, I hadn’t thought of something that dire! I meant a transmission or so… anyway, sounds like you’re pretty well covered. I’m still 19 years from retirement but I’m thinking about how I will draw down my accounts in retirement. I think I will be in a similar position – enough emergency savings (hopefully) to get me through some troubles, but I just can’t save enough to have a huge amount available.

@ Scooze: It’s awfully hard to save, especially when it feels like you go two steps backward for every one step forward. The most effective strategy, far as I can tell, is to have it subtracted from your paycheck automatically: either through a 401(k) kind of thing or by arranging an automatic monthly transfer from checking to savings on payday. Or if you get paid biweekly, put the two so-called” “extra” checks into savings, every six months.

Forgot to ask: how are things going w/ your son’s house? I ask because I’m in the midst of doing something similar w/ my son…

Pretty good. Much, much better now we’re no longer upside-down with the mortgage — that was something that really upset him.

An issue for a young single man is that it’s pretty difficult for him to care for the place on his own. When he has time, he does keep it clean, and he seems to enjoy gardening. But he works very hard, he works long hours, and he does have a social life, unlike his muther, and so cleaning and maintaining present a challenge. Unfortunately he doesn’t earn enough to hire cleaning help, which would be ideal.