Trying again to get this post online. Looks like the WP glitch is now fixed; it was apparently a bug in Akismet. But now I’m having a heck of a time getting it to post at all. Have a bad feeling this thing has gone out to subscribers two or three times, but when and in what form, I don’t know. My apologies if you’ve received one or more versions of this already! 🙄

Spent the past hour or so stealing a few minutes to cruise my favorite blogs, which I’ve neglected shamelessly over the summer. At A Gai Shan Life, what should I come across but a rumination on the psychology of frugality—of the tendency to hoard, actually—and of Revanche’s fairly recent revelation:

…the idea that Now Matters has sunk in.

Yeah. Revanche attributes this insight to the maturing relationship with PiC, now her fiancé.

I’m slowly beginning to get the picture, too, though it may never come in clearly without some degree of “snow.”

LOL! Revanche describes not Seven Kinds of Ambiguity but Seven Kinds of Hoarding: saving the best food for last, so that you can enjoy the good stuff after you’ve polished off the required vegetables and stuff your mom made that you’d better not complain about. Racing through all your chores so as to collect up plenty of “free” (you thought) time. Stashing the candy, so you’d always have some for later. And of course, squirreling away every g.d. penny toward some uncertain “future.”

To this day, I always carve out the heart out of a piece of watermelon and set it aside, so as to eat the sweetest, most delicious part at my leisure: later. And indeed I do try to get all the sh!twork out of the way so as to have more time later, either to work on more productive things or just to loaf. As for money…well, you know, I am “a little funny about money.” 😉

I believe this tendency is in the genes. It’s hard-wired. I got mine from my father, and my poor son, who is even more miserly than I, inherited a double-whammy from his grand-dad and from me.

But like Revanche, I also am beginning to suspect that we need to invest something in the Here and Now, and we need to do it…well, now, not later.

I spend way, way too much time and energy depriving myself. As Frugal Scholar observes wryly about herself, “I do have a tendency to be a little too hair shirt in the frugality department.” She has decided to make a conscious effort to “loosen up,” as she puts it, by way of observing a few small milestones in life.

The women are right. It’s time to get a life. You can’t keep saving life for a rainy day.

In keeping with this impulse and my existing scheme to simplify my finances, I decided that I needed to find the single simplest way to regard income and outgo and then arrange the money management along those lines.

The biggest and best (I hope) manifestation of said impulse is that I’ve determined to stop worrying about every penny that comes and goes month by month—a stressful exercise, given the irregularity of adjunct income—and instead take a big-picture view of the budget and living expenses. Every winter break and all summer long, I chew my nails and tear my hair because I think “Oh GOD! I don’t have enough to pay the bills.”

Well, yes I do. Over the course of an entire year, I have more than enough to pay the bills. Between Social Security and the income from teaching three sections a semester, enough comes in to cover regular bills, pay for necessities, and leave a little to spare. You don’t see that when you look at month-to-month income. But if you back up and look at annual income, it comes into focus.

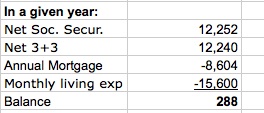

Videlicet: A year’s worth of income and outgo looks like this:

If I budget $1300 a month to supplement Social Security in covering discretionary and nondiscretionary costs, I just about break even, assuming I teach only three-and-three. But in fact, this year I’ve taught not six sections but nine, adding another $5,428 net to the bottom line. Thirteen hundred dollars is $200 a month more than I’ve been budgeting; it represents a more realistic figure in light of recent inflation. The income figures don’t include the $4,400 of RASL still owed to me in 2012, or the $2,000 or $3,000 income tax refund, or the annual American Express kickback, and so giving myself a little raise should be within reason.

Clearly, if I quit hoarding, I could afford to parcel out enough, month by month, to cover the bills. Occasionally there might even be enough to go out to dinner now and again.

One thing that’s made this not so obvious is that, in my terror that there just would not be enough to cover my share of the underwater mortgage on the downtown house, I started shoveling every penny of my salary directly into the joint account my son and I established to pay that mortgage. Over the summer, I had to stop doing that, because I needed the income from my summer classes to pay the exorbitant hot-weather utility bills. By the end of spring semester, however, I’d stashed enough in there to cover not only the three summer months but the entire year’s worth of mortgage payments.

This exercise made it clear that if I stopped doing that and instead transferred only enough to cover my part of the bargain, quite a bit of money would remain in my hands. Enough, indeed, to ensure that as long as I can dodder into a classroom, I’ll never have to draw down from retirement savings to put food on the table and a roof over my head.

Hmh.

If I were to put all my salary into Survival Savings (a money market account containing the fund of cash I had at the time I was laid off, which I’ve been slowly consuming by way of delaying drawdowns from IRAs and brokerage accounts), I could transfer $717 a month to the joint mortgage-paying account and $1300 to my checking account…and come out smelling like roses! Survival Savings has a balance of $9,464, so if this scheme begins on September 1, the numbers fall out like this:

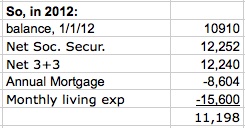

So what happens if I keep doing this in 2012? Again assuming I teach only three sections a semester, with no summer courses and no overload:

Yup, $288 to the good, not counting tax refund, 2012 RASL, the American Express card kickback, and the various other little windfalls that come my way. And that’s without having to teach in the summer! One summer course would cover emergency costs or keep me firmly in the black from now until Doomsday.

This zen-like strategy is made possible by the fact that I’d managed to squirrel away a substantial emergency fund while I was working full-time. After over 18 months, I still haven’t gone through it, despite a number of unpleasant financial surprises, like the $1500 on the teeth and the $800 on the car and the water bill of almost $200 and the power bill pushing $300.

So I can’t say that hoarding is a bad thing. Obviously, having built this stash by making myself think I was barely scraping by on $65,000 a year worked to my benefit.

However: it’s probably time to recognize that “Now Matters.”

The zen budgeting you present is kind of how I do mine–in 6-12 month chunks. Soooo, it looks like you can afford to go on a little vacation in the mountains with your doggies.