Yesterday at the weekly Scottsdale Business Association meeting, the assertion was again made that you should never pay off a mortgage in advance. If you have the money to do so, we’re told, you’ll come out ahead if you invest the money in securities and keep making those mortgage payments.

I wonder about that.

Years ago, I paid off my $100,000 mortgage. (Can you believe I managed to wiggle into a North Central house for a hundred grand? Another recession was on: it was during the savings and loan fiasco.) The university had hired me into a full-time position, which though nontenurable, paid as much as an assistant professor in my department earned. SDXB was paying half the mortgage, which I carried on my books as rent, turning the many upgrades the house needed into tax deductions.

Years ago, I paid off my $100,000 mortgage. (Can you believe I managed to wiggle into a North Central house for a hundred grand? Another recession was on: it was during the savings and loan fiasco.) The university had hired me into a full-time position, which though nontenurable, paid as much as an assistant professor in my department earned. SDXB was paying half the mortgage, which I carried on my books as rent, turning the many upgrades the house needed into tax deductions.

With a year or two of alimony to go, it occurred to me that a) I would like SDXB to move out of my house and b) if I were covering the monthly mortgage payment myself, it would consume exactly half my net pay. Even with SDXB’s help, I was spending a little more than my entire net pay each month; if he left, I wouldn’t be able to stay in the house.

However, I had an inheritance from a distant relative, and I also had earned a chunk of dough by writing Math Magic for Scott Flansburg. With those amounts in hand, I could scrounge up the rest to pay off the mortgage from a couple of small investment accounts.

Over my investment adviser’s strenuous protests, I did it: Paid off the mortgage!

On several occasions, I’ve been glad I did it:

• It allowed me to show SDXB the door.

• After I was promoted to head up the university’s scholarly editing project, the increase in salary allowed me to stash a lot of money back into savings, thanks to the absence of an onerous mortgage payment.

• When I was laid off the job, I was able to hang onto the house, which would not have happened if I’d had to make mortgage payments.

Because the value of the house was pretty small, in the larger scheme of things, the tax effects of getting quit of the mortgage were nil. Maybe if the house had been worth half a million bucks or so, or maybe if I were earning a living wage, it would have made a difference. But in my circumstances, it did not.

But the question keeps coming back to haunt: was it a mistake to pay off that mortgage?

So I applied a little English-Major Math to the issue. Here’s what I came up with:

Let us imagine you can buy a house for $100,000. You can finance it at 3.5% with no down payment (it’s before the Bubble, OK?). Incidentally, you happen to have $300,000 laying around in investments; of that, about $150,000 is not in tax-deferred instruments.

What would happen if you…

a) paid the $100,000 to a lender over 30 years; or

b) paid off the $100,000 in one swell foop?

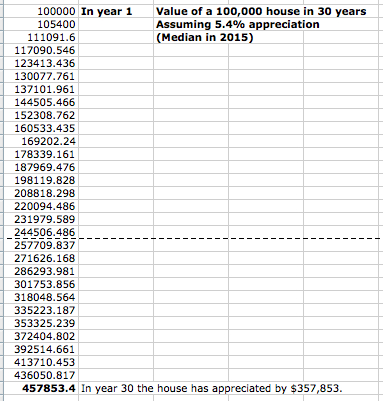

In 30 years at a 5.4% appreciation rate, your $100,000 shack will be worth $436,050. Subtract the Year 1 value of $100,000, which you paid in cash, and your net value for your house will be $336,050.

If you took that $100,000 and instead invested it in an index fund returning about 5% p.a., on average, after 30 years that fund would be worth $411,613.

At a glance, it looks like you’d do better to put the 100 grand in savings than into the house.

However…that doesn’t take into consideration the real cost of a $100,000 mortgage over 30 years.

According to Bankrate, the total interest and principal you’ll pay on that 30-year mortgage at 3.5% comes to $161,657 — not including tax and insurance. Again, it looks like we’ll do better to put the cash in a nice, calm index fund.

So, let’s think about that:

At the end of 30 years, you’ve paid $161,657 to buy a house that is now worth $457,853. The net value of the house ($437,853 valuation minus $161,657 total interest and principal payments) is $296,196.

If you had not financed the house but paid for it with $100,000 out of pocket, your net value for the house after 30 years is 357,853 (i.e., $457,853 – $100,000).

Okay, keep these figures in mind:

Finance the house: net $296,196 on sale of house 30 years later

Pay off the house: net $357,853 on sale of house 30 years later

Even though paying off the house looks better, these figures still make the $411,613 that could now be sitting in your index fund look very good. Sell the house for $296,196, and you end up with an admirable enough $707,809.

HoweEVER: what if you figured that if you could afford to fork over a monthly PITI payment to a mortgage company in the amount of about $625, you could afford to stash that amount in savings — after you’ve paid off the house?

If you invested $625 a month in a low-load index fund (Vanguard has two of them), in 30 years you would have $357,853. Let’s suppose you have the foresight to do exactly that: you pay your $100,000 in cash, and you invest the equivalent of the house payments over the course of 30 years.

Now you have a total of $769,466 ($357,853 + 411,613). That is $60,000 more than you would have had if you’d paid that $625 a month to a lender.

These prognostications depend strongly on interest rates. Mortgage rates are still very low just now — at the present 3.4%, it makes sense to buy a house with as large a home loan as you can get. But once rates rise above about 5 percent, that changes.

Over the past 30 years, the average 30-year fixed mortgage rate has been 7.19%. At times, it’s risen over an eye-popping 16%. The present extended period of cheap money pushes that average to a deceptively low level.

At 7.19% interest, your principal and interest payments on $100,000 would add up to $244,122 over 30 years. Now the net value of the house to you is $193,731 (i.e., $437,853 – 244,122). That doesn’t compare well at all with the $357,853 you would net on the house had you paid out that $100,000 lo these many years ago.

So, here are four strategies, in the order of effectiveness — from most profitable to least profitable.

1. Pay off the $100,000, then invest the equivalent of principal & interest payments at 5% (your net after 30 years: $594,103: value of house + value of index fund)

2. Finance the $100,000 at 3.5%; invest the amount of the monthly mortgage payments in a low-cost index fund (you end up with $532,446)

3. Pay the $100,000; spend the payment amounts to support a better lifestyle ($336,050)

4. Finance the $100,000 with a conventional 30-year fixed-rate mortgage at 3.5% and pay principal and interest until you’re ready to fall into the grave ($296,196)

Disclaimer: Don’t believe things you read on random websites! I am not a financial advisor. I am an aging English major who prefers playing with Excel to solving crossword puzzles. None of the above constitutes or is intended to constitute financial advice.

Living in California, the concept of a $100k house is hilarious 🙂

But, the rationale is similar – my mortgage rate was 4.25% when I started – I actually refinanced about 18 months in, at 3.25%.

a 30 year mortgage – when I started, I was 34 – meaning that I would be making my final payment on the house at age 64. Which frankly, freaked me out.

I’ve been making extra principal payments and the plan is to have the house paid off in just under 10 years. It’s a tradeoff – the extra funds that are going toward mortgage, could be going toward index funds – but I really want the mortgage gone!

If I really really wanted it gone – I could get a housemate – apparently these days renting a room out can net you up to $1200 a month! Which is insane. I really do enjoy living alone though…

It’s hard to find a decent roommate. Some of the shenanigans friends have encountered lead one to feel $1200/month is too low. 😉

IMHO making extra payments to shorten the life of the loan is a good strategy, even though the interest is spectacularly low. If you figure the amount of the monthly payment you don’t have to pay, once the loan is paid, to keep a roof over your head: that’s the return on your investment. So if P&I is, say, $1,000, that’s the amount your investment in the house returns after the loan is paid off.

LOL! Today $100,000 would get you into a very sketchy neighborhood here, or into a pretty sad apartment. Or maybe a nice trailer. But it’s a round number and easy for the math-challenged (i.e., moi) to fiddle with.

Let us not forget….”liars figure and figures lie”. I have been and remain “torn” with the scenarios you describe. And I am well aware that the best time to borrow money …. is when you don’t need it. In this neck of the woods lenders are beating the bushes looking for qualified borrowers. At my credit union I can borrow money at a ridiculous rate….I can borrow up to $400K @2.25% for 10 years …. no points ….AND could even get help with closing costs. If one had the “guts” they would borrow $200K and send off the proceeds to TIAA-CREF to work their “magic”… BUT there is something to be said for being “mortgage free” and there are no guarantees that the stock market will continue it’s climb. Within walking distance of my home they are selling new homes on postage stamp lots for +$700K….I can only imagine what the payments are….and the anguish I would feel at being tied to such a burden for 30 years. Aaaand over 30 years ago I was a “trend-setter” and was in the thick of the battle to buy a home when interest rates were 16% plus points. We managed to get a rate of 13.625 with one point….the loan officer said he was “giving the money away”…. Funny….it didn’t feel like such a gift….

Wow…2.25 percent! I wonder if our credit union is doing that. I need to get the pool replastered this winter, but if I do that, there won’t be ten grand left to put in the proposed index fund. (Vanguard sets a minimum initial investment of $10,000 for the Vanguard 500 index fund — here’s an interesting piece on that subject from The Motley Fool, btw: http://www.fool.com/investing/general/2015/07/23/vanguard-500-index-fund-low-cost-but-are-there-bet.aspx)

If I could borrow enough to re-do the pool ($4,000 to $6,000, I expect), a Heloc would be sort of tax deductible (like I pay a lot of taxes! :roll:). And it would leave plenty to buy into the desired fund.

Yeah… Richistan, just across Feeder Street NS, is full of $700,000 to million-dollar houses. Ugh! Crazy prices…but the prospect of being in one of those elbow-to-elbow chicken coops isn’t very appealing, either. I suppose if you had 700 grand to toss around, it might be worth it just to have some space between you and the neighbors.

When I bought that $100,000 house, back in another century, the interest rate was over 8% — seems to me it was 8.6% — and we thought it was a bargain!

I’d never invest borrowed money. That’s what people did during the run-up to the Great Depression — they borrowed, often on margin, and invested the borrowed money in the market. When the market crashed, they were royally screwed.

I would check the CU out….Pretty sure these numbers don’t work with small amounts with the fees involved….BUT your “mileage may vary”….certainly worth a look. I think the key is discipline….If one were to borrow the $200K it would need to be invested in rental property or a mutual fund or stock. For many the temptation is TOO MUCH and it winds up being used for new cars/ 4-wheel drive double cab Ford pickups with turbo-diesel and King Ranch Package…. When you run the numbers side by side…the 2.25% to borrow and an investment return of 7.5% it gets crazy. Sooo maybe you could get a new mortgage….fix the pool….go on vacation…buy a new vehicle ….etc…etc…This is the kind of thing that keeps me up at night!

Boyoboy…I personally am sure glad I didn’t have borrowed money invested in much of anything along about 2008. We came close to defaulting on the downtown house, except that my son resisted with all his strength. We did manage to hang on, and it’s now worth about $12,000 more than the inflated price we paid for it back in 2004. Not a good return on investment, but at least we’re not upside down anymore.

When you do run those numbers side by side, there are so many complicating factors that it makes your head hurt.

Yeah, sure: you borrow at 2.25% and invest in, say, some EFT. Vanguard’s index EFT, for example, looks on the surface like it’s not costing you anything, but in fact they assess $20 for every transaction. Every time you put more money in: $20. Every time you withdraw money: $20. That could add up enough to change the real amount of the return.

Similarly, let’s say I borrow at 3.5% to buy a house that theoretically will appreciate at 5.4% (the average rate of RE appreciation). However, I have to pay property taxes and insurance on the shack; the plumbing springs a leak and the slab has to be jackhammered up to fix that; the renter lights a campfire in the middle of the living room, grousing that the least I could have done was provide him a decent fireplace; a tornado blows through the neighborhood a half-mile to the south, so the insurance company jacks up the homeowner’s insurance when the policy comes due; a shade tree heaves the back wall, requiring that the tree be removed to the tune of $1000 and the wall be rebuilt to God only knows what tune… Am I REALLY making 5.4% on the appreciation of this damn thing? I’ll bet I’m netting about 3.5% to 4%. If I’m lucky…

Hmmm…….As a matter of fact took a call yesterday from a tenant…”no water/fluctuating water pressure”….they are on a well…this is never good. Add to this I’m leaving for the Beach in a day….so this makes the timing PERFECT. I call my “pump guys” and of course it’s Saturday and the office closed at 12. So I get the “emergency #” and call that. The guy tells me he can be there in about 3 hours. So I go to pick up DD2 from the airport and take the call around 4 hours later from my “pump guy” ….”water-logged” water tank . Which translated means the bladder has failed. He assures me he can fix this for….$1350….MAN….I replaced the last tank and pretty sure parts were like $350. BUT my folks need water and I’m going to get a sun burn in a day. I gave him the “nod” to go ahead and to call me with any problems. I got no call so I’m assuming, things went well. I’m gonna talk to the GM about the pricing when I’m invoiced. I’ve used these guys 40 years…so perhaps there will be some “mercy” given.

And as for Vanguard….I always thought there was a lot of hype with these guys….and I’m not a fan of the $20 “hits” every time you do something with YOUR MONEY. I looked at their material and decided to pass and go with the TIAA-CREF folks. A bit more $ BUT I have been happy with their service and the results.

As for real estate…it’s a 3 legged stool on investing. I have found the returns come from…. profits from the rents…..the tax benefit from depreciation and “losses” applied against other income to lower your taxable rate…..and finally capital appreciation ….which CAN be significant. My “problem” is with the performance of folks like TIAA-CREF and Vanguard, it does make you question your sanity with rental property at times. Case in point, I just got my statement for the 1/2 year from TIAA-CREF and even with Brexit they are on course for a 13.5% gain for the year. 13.5% and no calls from tenants or “pump guys”…. What’s not to like?

Ugh, what a pain! Sorry you didn’t have time to get some comparative bids…but usually when you’ve been working with a company that long, they’re less likely to rip you off. Unless, o’course, they’ve been acquired by someone else.

Problem with the 13.5% gain in TIAA-CREF is that like any stock market investment, it’s easy come, easy go. It can be up 13.5% one month and then down that much. Oh well.

We had TIAA-CREF in the university’s 403(b). At the time, it wasn’t performing as well as my two Vanguard funds. Vanguard would be moving upward and TIAA-CREF would be flat, even in a sustained bull market. The only TIAA-CREF choice that made money for me was the REIT. Fortunately, I was out of it by the time the crash came along.

When it comes to this topic, the words “never” and “always” as part of any advice given completely infuriate me. I don’t think that paying off your mortgage is ever a bad idea, regardless of any of the numbers that people might put in front of you. There are other things to consider that go beyond the stuff that people will put up on a wall in a group presentation. You greatly reduce your cash outflows if you pay off your mortgage. You have less to cover in the event of a job loss or partial loss of income. Your risk of going underwater on your mortgage falls to zero.

Bottom line, there is a LOT of peace of mind that comes with paying off a mortgage, or at least there can be. For some, that might not play in at all, and in that case, go 100% with the numbers. But for others, just knowing that they have just knocked off what is probably the biggest check they write every month can help them sleep better at night and reduces their stress, not to mention all of the other things I just listed that go along with it. Just because you can’t put a price on all of the the things I listed doesn’t make them any less important, and I think that any responsible advisor should acknowledge that to some degree.

Yes. Peace of mind is priceless…no question of that.

And once you’re under a paid-off roof, the cost of living from day to day is surprisingly low. If your house is paid off, you may be able to escape the salt mines a lot sooner than you think.

The “never” and “always” pitch is annoying. There are no absolutes in life and apparently none in personal finance. As a financial advisor should try to assess a client’s tolerance for risk, so the homeowner should consider his or her risk tolerance when it comes to paying off the house.

–> How comfortable or uncomfortable will you feel about having to make mortgage payments if you lose your job?

–> Do you have other savings that you can fall back on in the event of a layoff or medical disability?

–> How uncomfortable are you about the possibility of losing money in the stock market?

–> Do you intend to live in the house till you topple over into the grave, or do you regard it mainly as a financial investment that you happen to be occupying for the moment? If the house’s value drops below what you owe on it, will that matter to you?

–> When do you plan to retire?

–> Whenever you do retire, do you plan to stay put, or do you plan to move someplace else? If the latter, is the cost of real estate higher or lower in that place?

So many variables play into this decision that no one can say, with even the vaguest certainty, that everybody should always or never follow any given strategy.